Latest EV Insurance Trends: Shaping the Future of Auto Coverage

As the automotive landscape continues to evolve with the rise of electric vehicles (EVs), the insurance industry is adapting to meet the unique needs of EV owners. This article explores the most recent developments in electric vehicle insurance policies and how they're reshaping the industry.

1. Tailored Coverage for EV-Specific Components

Insurance companies are now offering specialized coverage for EV-specific components such as batteries, charging equipment, and electric motors. These policies address the higher replacement costs associated with these advanced technologies, ensuring that EV owners are adequately protected.

2. Usage-Based Insurance for EVs

Digital car insurance providers are leveraging telematics and connected car technologies to offer usage-based insurance (UBI) specifically designed for electric vehicles. These policies take into account factors such as charging habits, energy efficiency, and driving patterns to provide more accurate and personalized premium rates.

3. Cybersecurity Coverage

With the increasing connectivity of EVs, insurers are introducing cybersecurity coverage as part of their electronic insurance offerings. This protects against potential hacking attempts, data breaches, and other cyber risks associated with connected electric vehicles.

4. Environmental Benefits Incentives

Some insurance companies are offering discounts and incentives for EV owners, recognizing the environmental benefits of electric vehicles. These may include lower premiums, additional coverage options, or rewards for eco-friendly driving habits.

5. Simplified Claims Process

Digital car insurance providers are streamlining the claims process for EV owners through mobile apps and AI-powered assessment tools. This allows for faster claim resolution and more accurate damage assessments specific to electric vehicles.

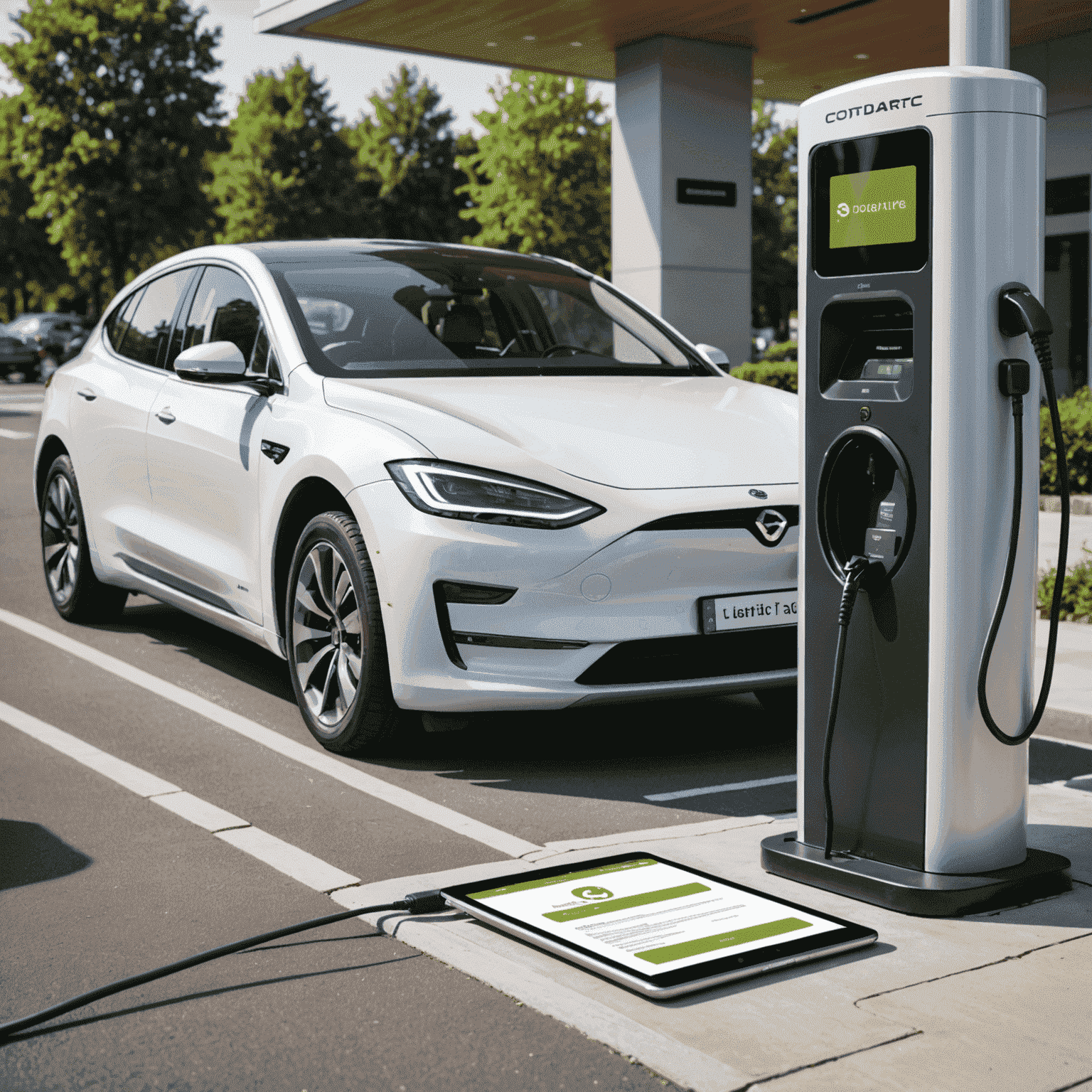

6. Charging Station Coverage

Some insurers are now offering coverage for home charging stations as part of their EV insurance policies. This protects against damage, theft, or malfunction of the charging equipment, providing added peace of mind for EV owners.

Conclusion

As the EV market continues to grow, especially in regions like Canada where Saferoute operates, insurance companies are innovating to meet the unique needs of electric vehicle owners. These trends in electronic insurance for EVs demonstrate the industry's commitment to providing comprehensive, tailored coverage that addresses the specific risks and benefits associated with electric vehicles. As technology advances and the EV market matures, we can expect to see even more specialized and sophisticated insurance solutions in the future.